Wage Growth in the United States-Pre and Post Pandemic

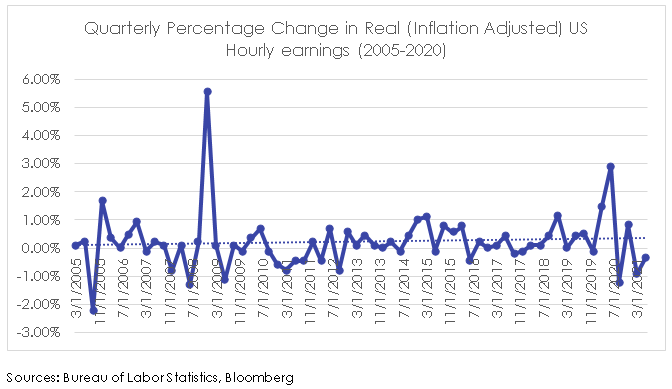

In my June 2016 Current Thinking post Wage Growth in the United States-Positive Factors and Counterweights, data confirmed that real (inflation-adjusted) wages in the U.S. were relatively stagnant over the prior 15 years. While there was movement both up and down, there was no clear long-term upward trend in overall real wages1.

The importance of wage growth is illustrated in that, for the United States, personal spending comprises 68% of Gross Domestic Product (GDP), while wages and salaries comprise almost 60% of income before taxes2.

Two follow-ups from 2016 are: (1) has the trend in real wages changed since then?; and (2) are there factors related to the Covid-19 pandemic which might change the earnings growth dynamic going forward?

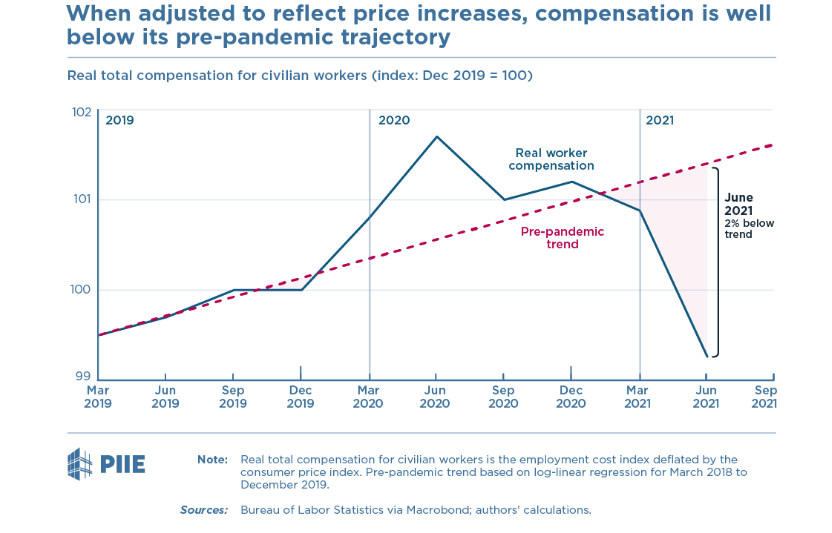

To the first question, the above chart suggests that the overall trend in real wages has not significantly changed since 2016. While real wages grew between 2019 and mid- 2020 by 5.3%, this gain has been offset by the effects of the Covid-19 pandemic. This is captured more starkly by the chart below, which indicates that worker compensation in June 2021 was 2% below its pre-Covid trend.

To address the second question, we can look at several drivers in a post-pandemic environment that might be expected to move real wage growth toward at least the pre-pandemic trend-but also could keep us stuck at below trend growth:

Labor Market

+ The uneven recovery from the Covid-19 pandemic, continued massive support from the Federal Reserve and federal stimulus has gradually moved employment toward pre-pandemic levels. Recent upticks in inflation are expected to be transitory. Growth in real wages will likely depend on resumption toward normal work and hiring activity (particularly in the leisure and hospitality industry), the ability of employers to attract workers and the accommodation of alternative arrangements, such as remote work. On the federal level, the American Families Plan includes funding and tax credits for childcare.

–In addition to loss of jobs from the pandemic, labor force participation remains near record lows at 61.7% of the working age population, driven primarily by the challenges of child care facing people re-entering the workforce, increased baby boomer retirements and workplace safety concerns. This has hampered the ability of employers to attract workers, even at higher levels of offered pay. A large part of baby boomer early retirements can be attributed to loss of employment and income from the pandemic; it is also possible that some believe they have enough savings to carry them through retirement years.

Education

+ There has been significant growth in post-secondary higher educational attainment, which should lead to higher lifetime earnings potential. The $3.5 trillion social infrastructure bill being considered in Congress includes provisions that allow for two free years of junior college and universal pre-kindergarten. The mix of future occupations will matter-employment in alternative energy and “green jobs” are expected to increase; while there is also expected to be high demand for workers in fields such as engineering and information technology (IT).

–There continue to be high levels of student debt. Covid-19 has delayed learning for school-age children, particularly in poorer communities, so additional resources will be needed for children to catch up.

Productivity and Automation

+ Worker productivity has generally grown at a steady clip. Over the longer term, this should enable wage growth without employers passing along labor cost increases to consumers.

–The pandemic has increased a trend away from human contact. This has accelerated the movement toward automation-particularly in restaurants, retail sales and manufacturing.3

In summary, while there are complex factors explaining trends in wage growth, particularly in the pandemic environment, people re-entering and remaining the workforce is of primary importance. As Federal Reserve Chair Jerome Powell stated in July 2021, “We lag all of our peers in labor force participation now, which is not where we want to be as a country”.4

NOTES:

- These are only averages and do not take into account the significant differences between the highest and lowest wage earners.

- Source: Bureau of Economic Analysis.

- Rockeman, Olivia. “Swathes of U.S. Workers Are Missing in Action: New Economy Daily”, Bloomberg News, August 5, 2021.

- IBiD.

NOTE: Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities. Past performance is not a guarantee of future results.