How Well Have Employer-Provided Benefits Kept Up With Pay?

It has been well documented that growth in average employee pay in the United States has struggled to keep up with inflation. Data from the Bureau of Labor Statistics (BLS) indicates that from 2013-2018, average weekly earnings after inflation (real earnings) increased at only a 1.2% annualized rate. That is, while inflation has averaged 1.5% annually over the 2013-18 period, wages and salaries have increased by 2.7% per year, a 1.2% difference. To the extent that benefits are a key component of overall compensation, have benefits increased at a faster rate than earnings, thus offsetting part of the sluggish growth in wages?

To begin to analyze this question, we can look in more detail at compensation data from the BLS. In the aggregate, the share of total benefits as a component of total compensation increased from 30.9% in 2013 to 31.7% in 2018. The main benefits category showing the greatest share of total compensation increase was retirement and savings (defined benefit (DB) and defined contribution (DC) plans), which increased from 4.7% in 2013 to 5.3% in 2018. Conversely, the health insurance share decreased from 8.5% to 8.3% over the same five-year period.

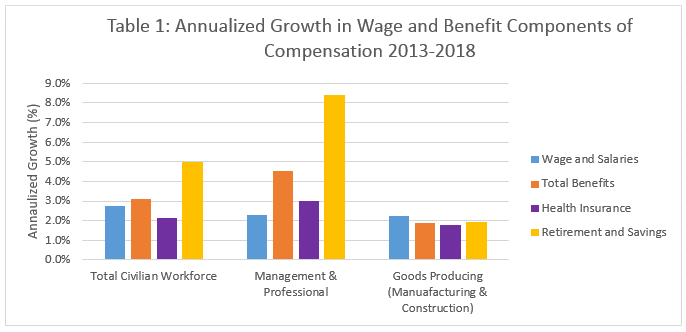

Growth rates in wages and benefits, as expected, vary by broad occupational category. Table 1 below indicates that for Management and Professional workers, benefits have grown at a faster rate than wage and salary income, with retirement and savings benefits (DB and DC) growing by over 8% annually in the past 5 years.

Table 1

Conversely, benefits items in manufacturing and construction industries have grown at similar rates (2% or below) and have grown at a slower rate than benefits for management and professional workers.

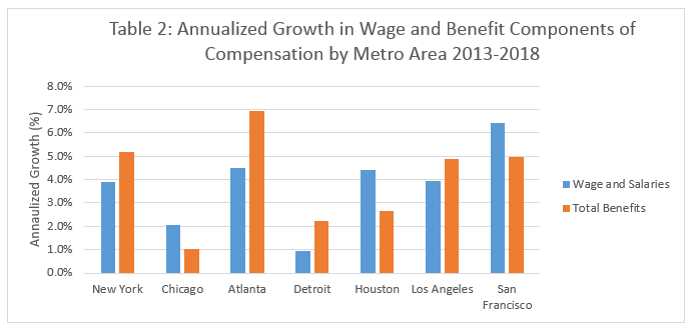

We can also look at selected urban areas surveyed by the BLS. Table 2 below shows wages, salaries and benefits growing at the fastest rate in the Atlanta and San Francisco areas, followed by New York and Los Angeles. In Detroit, benefits at least partially closed the lag in total compensation, while for Chicago, a slow growth rate in benefits lagged wage growth. It is possible that in some metropolitan areas, the growth rates in benefits are driven by higher costs of insurance.

Table 2

In summary, the primary component of employee compensation, wage and salaries, have been growing, but at a sluggish pace. It appears that benefits taken as a whole have, to some extent, contributed positively to overall compensation growth over the past five years. However, it also could be argued that benefits are just becoming a bigger piece of a slowly growing pie.

NOTE: Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities. Past performance is not a guarantee of future investment results.