Can US Value Stocks Make a Comeback?

Over the past several years, US growth stocks have left US value stocks in the dust from a return standpoint, outperforming value stocks by wide margins. However, this has not always been the case and, recently, value stocks have begun staging a comeback.

Growth stocks are generally those that are high priced relative to their book value (i.e. the value recognized on the company’s balance sheet), but are projected to have high earnings growth potential. Value stocks generally trade below their book value and are considered by value investors to be “cheap” compared to their true market value.

Stocks and market sectors are assigned to a growth or value style index by the major index providers such as Standard & Poors (S&P) and FTSE Russell. The major style indexes for large and mid-capitalization stocks (which comprise most of the total US public equity market) are the Russell 1000 Growth and Russell 1000 Value Indexes. The Russell 1000 Growth Index is dominated by its largest sector, Technology. Its top 5 stocks are Apple, Microsoft, Amazon, Facebook and Tesla. On the other hand, the Russell 1000 Value Index’s largest sectors are Financials, Industrials and Health Care. Its 5 largest stocks are Berkshire Hathaway (Financials), JPMorgan Chase, Johnson & Johnson, Verizon and Walt Disney. The S&P 500 Index is comprised of both growth and value stocks.

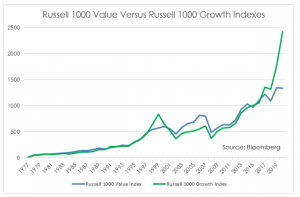

The chart below shows that over a number of historical time periods, value stocks have generated higher returns than growth stocks. However, growth stocks have significantly outperformed value stocks in recent years. From January 2016-December 2020, the Russell 1000 Growth Index has returned 21.0% on an annualized basis versus 9.7% for the Russell 1000 Value Index. The return gap was even larger in 2020: 38.5% for growth stocks and 2.8% for value stocks.

Why have growth stocks dominated value stocks over the past several years?

- The top technology growth stocks (plus Amazon) have been dominant players in their industry. They were dominant before the Covid-19 pandemic in early 2020. Since then, these stocks have retained their leadership in the virtual “work at home”, “stay at home” pandemic environment. Conversely, industrials, which have a high representation in the Russell 1000 Value index, have been hurt by economic slowdowns and manufacturing shutdowns during the pandemic.

- Growth stocks have been trading at record multiples, including the key measures of price-to-earnings and price-to-cash flow. Those who believe that these multiples have created a “bubble” that is likely to pop at some point are still waiting. Many investors continue to be willing to pay premium multiples for these companies’ projected double-digit growth and continued market power. In addition, growth companies have consistently beaten Wall Street earnings estimates.

- Growth stocks have been a favorite of retail investors who often trade through commission-free platforms such as E*TRADE and Schwab as well as apps such as robinhood. These investors tend to be trend followers and frequently buy heavily into the market, including through options, based on favorable news, rumors, and/or attempts to time the market.

- Growth stocks have benefited from low interest rates and Federal Reserve (Fed) policies that have pumped trillions of dollars into businesses and financial markets. Value stocks such as financials have generally been hurt by low interest rates which have diminished bank interest margins.

What factors might lead to a comeback in value stocks?

- If Covid-19 vaccines lead to a faster than expected economic and social recovery, there could be movement out of the “stay at home” tech stocks into value-oriented industrial stocks such as Boeing and Caterpillar as well as into beaten-down transportation and leisure company stocks.

- Investors could realize that the record multiples in growth stocks are too high and don’t justify their ultra-high prices. However, there has been little evidence of that realization over the past several years, particularly given massive Fed support and low interest rates.

- Policy changes and legal actions going into the new administration could impact the large tech stocks. In 2019 and 2020, the Federal Trade Commission (FTC), the states and the Justice Department initiated antitrust investigations into Google and Facebook. While it is unlikely that these companies will be broken up anytime soon, threats to their dominance are likely to benefit value stocks.

While a value stock comeback cannot be forecasted with any degree of certainty, maintaining a diversified portfolio remains a critical part of a solid and well-planned investment strategy.

NOTE: Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities. Past performance is not a guarantee of future investment results. Diversification does not guarantee a profit or protect against loss.