The Relationship Between Stocks and Bonds-Is It Changing?

A blog by Frederic Slade, CFA, Assistant Vice President and Senior Director, Investments, Pentegra Retirement Services – January 3, 2017

An important underlying driver of historical United States capital market performance has been the relationship between bond market returns and stock market returns. Statistically, this relationship is known as correlation. An example of a negative correlation is when equity returns have gone down and bond market returns have gone up (“down-up”=negative correlation). This behavior has historically resulted from flights to safety as investors have fled to the safe haven of United States Treasuries as a result of events such as the 2008 financial market crisis. A positive correlation has resulted from optimistic investors driving up stock prices when interest rates have declined and bond prices have gone up (“up-up”=positive correlation). However, as we will see below, a positive correlation can also reflect a shift away from stocks when interest rates rise and bond returns fall ( i.e. “down-down” equals a positive correlation).

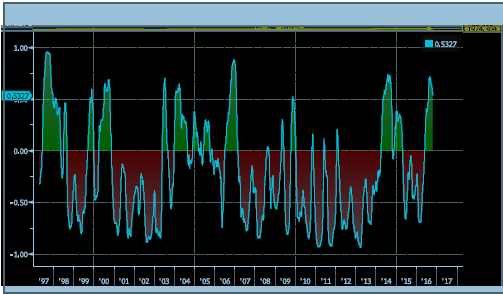

The chart below from Bloomberg illustrates the correlation between the S&P 500 total return index and the total return of United States Treasuries of maturities 10 years or greater.

Correlation Between the S&P 500 Index and 10+ Year Treasury

As can be seen, most periods after the mid-1990s were dominated by negative correlations (the red areas). These periods were highlighted by the financial crisis of 2008, the Egyptian political turmoil in 2011, the Greek political/economic turmoil in 2012 and the Russian political crisis in 2013,

What about the green positive correlation periods in 1997-98, 2004-06 and 2014-15? These periods were generally exhibited by moderately falling interest rates and bull markets. This type of favorable market environment was characterized by economists as “not too hot, not too cold”, in that inflation and interest rates were benign while economic growth was strong.

What about more recently? The positive correlation since June 2016 appears to differ from relationships in the other periods. As noted above, two “negatives” can produce a positive. That is, when equity returns go down and bond market returns are also down due to rising interest rates, a positive correlation results. In the current market environment, the heightened probability of a Federal Reserve interest rate increase coupled with historically high valuations in the equity market suggest that, despite day to day market volatility, this somewhat unwelcome correlation may persist into the near future. However, in this environment, there are still potential positives: (a) higher rates on money market instruments; (b) lower pension liabilities as discount rates rise; and (c) increased capital flow from non-US economies attracted to higher yields.

Can we revert to earlier correlations? Yes. A global recession, Fed easing or a rally in equities may cause the markets to revert to back to negative correlations, or back to the more benign positive correlations such as in 1997-98, 2004-06 and 2014-15.

NOTE: Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities. Past performance is not a guarantee of future results.

Comments

No comments.