How Should Retirees Approach the Decumulation Phase of Their Retirement Savings

Despite the evidence that, in general, those who have retired – especially those who have been retired for a significant amount of time – are spending less and at a slower rate than might have been assumed, there would seem to be little reason to believe that this behavior will hold true for future generations.

However, while experts continue to exhort all currently employed Americans to adopt a prudent approach to accumulating savings for retirement, what do they recommend to those already retired when it comes to “decumulation”?

In its annual survey of retirement habits, Go Banking Rates found that 42 percent of Americans have less than $10,000 put away for retirement, while 57 percent of Millennials – the youngest subsector of Americans working today – have $10,000 or less saved for retirement. 1 According to the Bureau of Labor Statistics, in 2016 the average annual expenditures for persons aged 65 and older was $45,756.2

The transition to retirement is not just a financial one; it’s also a psychological one. There are many factors to consider as you enter this phase. For your entire career, you have been focused on saving—and on the amount needed to retire securely. Once you make the decision to retire, there’s another amount that you need to focus on: how much you can spend each month, and which source of retirement income it will come from. This is what the industry calls “decumulation,” or the process of distributing the savings you have spent your lifetime accumulating. How you spend your savings is as important as how you accumulated them. Many of the same factors that shaped your savings decisions will also shape how you spend your savings.

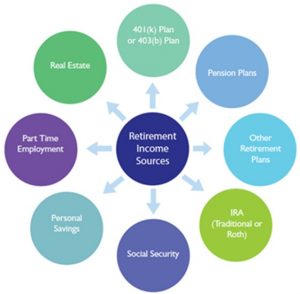

For many retirees, this can be overwhelming and often confusing. You may have savings from many different sources—employer-sponsored retirement plans, such as 401(k) or pension plans, plus Individual Retirement Accounts (IRAs) and Social Security.

As you consider how to maximize your retirement income, you may be concerned about how to balance spending too much in the early years of your retirement and running out of savings, or being too frugal and leaving excess savings behind. Most of us face real risks related to inflation, longevity and market volatility. A primary concern for many baby boomers will be how to “pensionize” their retirement savings.

Many of your income sources offer different methods of distribution that you will need to choose from. The first step is to understand which options are available to you from each of your potential income sources, and the advantages and implications of withdrawing funds from each.

Annuities

Investing in annuities could be attractive to retirees looking to manage longevity risk.3 Lifetime income annuities provide a way to maximize retirement benefits to provide comfort and security throughout retirement; in effect it delivers a guaranteed monthly income based on the retiree’s accumulated retirement benefits for as long as one lives and, if the retiree so chooses, for as long as their beneficiary lives.

Annuities may be an ideal choice because they enable you to make long-range plans by providing basic financial security—so that you can use personal savings and other income sources for whatever you like, without worrying about using all your retirement income. In-plan annuities also offer key tax advantages. The tax code specifically protects money in retirement plans, deferring taxes until you receive the income.

Determining the best kind of annuity involves examining an individual’s sources of retirement income, how they are invested, the retiree’s health, and the health of their beneficiary. Different types of annuities pay different levels of income because they take different factors into consideration.

Installment Payments and Distributions Over Time

Installment payments are another way to structure your retirement savings to provide regular income throughout retirement. An installment payment program also lets you make long-range plans so that you can use personal savings and other income sources for whatever you like without worrying about using all of your retirement income. Installment payments generally offer a great deal of flexibility in structuring your payments. Under this option, installment payments offer you the ability to create an income stream and payment cycle that works best for you.

Considerations

As with a savings accumulation plan, we recommend you devise a decumulation strategy. Realistically determining what one expects to comfortably spend on a monthly basis — including mortgages, children’s college loans, car payments, and other outstanding debts – can just be the start. Budgeting for expenditures above and beyond those – downsizing/relocating, taking long-deferred trips, and so on – will, as a result, be easier to map out.

Another consideration—potential health/medical expenses. There is no perfect formula for the guesswork involved here, but examining not only one’s own health but also family health histories, potential health effects of one’s environment – and remembering the general trend towards longer life expectancies – can help formulate an informed outlook.

Consider investigating an annuity. As illustrated above, these can guarantee income for a retiree’s lifetime, and/or that of their beneficiary.

Meet with a qualified financial advisor who specializes in retirement planning. Ideally this will have already been done during one’s working years, but either way it is highly recommended to ensure that the retiree understands what their options are – and what can work best for them.

1 Cameron Huddleston, “Survey Finds 42% of Americans Will Retire Broke – Here’s Why,” GOBanking Rates, March 6, 2018.

2 Bureau of Labor Statistics, “Consumer Expenditures – 2016,” August 29, 2017.

3 Academy of American Actuaries, “Risky Business: Living Longer Without Income for Life Information for Current and Future Retirees,” October 2015.

This material is provided solely for informational purposes and does not constitute investment, tax, legal or accounting advice on the matters addressed.

About the Author