How Healthcare Impacts Retirement Savings

Healthcare is generally one of the largest expenses during one’s retirement and costs continue to rise. These costs are rising primarily due to an aging population and longer life expectancy rates. According to Fidelity Investments, an average retired couple age 65 in 2021 may need approximately $300,000 to cover healthcare costs in their retirement years . This estimate also excludes long-term care. Medical costs may significantly impact individuals’ retirement savings and reduce their retirement income if they are not prepared for these expenses.

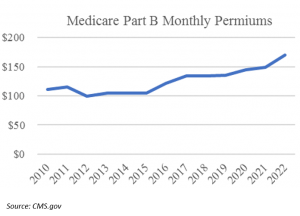

Since 2007, an enrollee’s Medicare Part B premium is based on income, which means the more an individual makes, the more they pay in premiums. (Refer to Income Related Monthly Adjustment Amount (IRMAA) brackets at Medicare.gov for more information.)

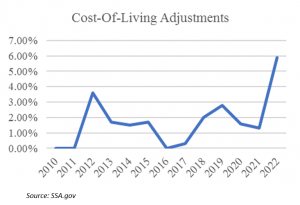

Another important point to keep in mind is that the majority of those with Medicare will also see a 5.9% cost-of-living adjustment (COLA), which increases an individual’s Social Security benefit. This is the largest increase in 30 years. This COLA increase should cover the increase in the Medicare Part B premiums for most retirees.

1 https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

2https://www.aarp.org/health/medicare-insurance/info-2021/part-b-premiums-increase.html

Listed below are a few steps participants can take now to prepare for these rising healthcare costs in retirement:

Utilize A Health Savings Account (HSA)

An HSA is only available in conjunction with a high-deductible health plan. If your company offers an HSA program, now may be a good time to remind employees of this benefit and how to enroll. HSAs can be an effective and tax efficient way to save for healthcare costs in retirement. These accounts are triple tax-free meaning:

- Contributions are made on a pre-tax or tax-deductible basis

- Savings will grow tax-free

- Withdrawals are also tax-free if used to cover qualified medical expenses

There is also a lesser known fourth advantage – Contributions made through a payroll deduction avoid Social Security and Medicare taxes, commonly known as FICA (Federal Insurance Contributions Act) taxes.

Consider Postponing Retirement

Approximately one-third of early retirees who claim Social Security benefits at age 62 are doing so to help pay for medical expenses until they turn age 65 and are eligible for Medicare[1]. It’s important for participants to know their healthcare options prior to retirement. If an individual does not have access to an employer-sponsored healthcare plan or a spouse’s plan, waiting at least until age 65 until they are eligible for Medicare can be beneficial. Alternative options include COBRA and private insurance, but both typically come with a higher cost.

Social Security is always an important topic for participants getting ready for retirement. However, participants often need more than education, they need personalized planning on how to tie Social Security in with their other savings. A retiree can start taking Social Security at age 62 but their benefit will be smaller throughout the duration of their life – monthly benefits may be reduced by up to 30%. The longer someone waits to collect Social Security benefits, the higher the benefit will be. The benefit increases between 7.5% and 8% every year that you wait from full retirement age (which varies depending on when you were born) to age 70.

Where A Retiree Lives Matters

Where an individual lives in retirement can also impact healthcare costs. Although traditional Medicare coverage is the same throughout the country, Medicare Part C, also known as Medicare Advantage, and Part D, which covers prescription drugs, could vary. These plans are sold privately and vary by state. In the case of Medicare Part C, these plans generally have a limited-service area so a retiree could lose coverage if they move.

Income In Retirement

Encouraging participants to start saving early and increase their contribution amount over the course of their career to cover future healthcare costs in retirement is important. Catch-up contributions are another way participants can save more. Catch-up contributions allow those age 50 or older to contribute an extra $6,500 to a 401(k), 403(b) or 457 plan and an extra $1,000 to an individual retirement account (IRA) in 2022.

3https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

Healthcare cost in retirement can have a significant impact on savings. Encourage participants to work with a financial professional to plan ahead.

This material is provided solely for informational purposes and does not constitute investment, tax, legal or accounting advice on the matters addressed. Participants should always consult with a qualified professional to better understand their options.

About the Author