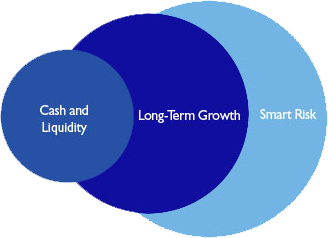

Cash and Liquidity

As an ordinal sequence, liquidity is always the foundation to our approach. All institutions require liquidity to prudently manage their respective liabilities, whether it is a pension obligation, spending policy, short-term strategic reserves for operations or managing a bond covenant. We refer to this as our client’s “sleep at night” number. By establishing with specificity what each client’s liquidity needs are now and into the future, we can build a portfolio foundation to meet those needs, even in times of market crisis. History has demonstrated that the markets rarely provide liquidity when it is most needed, so by starting with liquidity, we eliminate this risk, and avoid becoming a forced seller or forced buyer in times of stress.

Long-Term Growth

With a liquidity foundation in place, we seek to generate the growth necessary to maintain the long-term sustainability of our client’s assets. This is principally accomplished by holding total return-oriented equity and fixed income assets across liquid, publicly traded securities with regular rebalancing. While we utilize some active strategies, this component of the portfolio predominantly utilizes a passive approach. We believe this approach provides significant portfolio efficiency and cost effectiveness – and as history has shown, traditional active managers often struggle to beat their respective benchmarks, net of fees.

Value-Added "SmartRisk"

For those clients where it is policy appropriate, we seek to enhance return per unit of risk by pursuing what we refer to as “smart-risks” – identifying investment opportunities that challenge the efficient market hypothesis. We accomplish this principally through alternative investments – private equity, real estate, private market loans, and select direct hedge fund strategies. By having already provided for our client’s liquidity needs, we are able to capture a “private market” premium that provides meaningful return enhancements.