Pension Funds and Infrastructure Investment

Infrastructure, as broadly defined, is the basic system of services that a country and a society needs to function properly. Infrastructure includes physical systems such as the roads, air and railway networks, utilities, sewage and water. Infrastructure also includes services such as law enforcement, emergency services, healthcare and education. Nearly everyone, regardless of political orientation, believes we need to maintain and improve the infrastructure in the United States. Since the benefits of a sound infrastructure exceed the benefit to any one individual or corporation, the costs of infrastructure have largely been funded by the federal, state and local governments. However, the funding and taxation of infrastructure projects are also a political process. In many cases, much-needed infrastructure has been pre-empted in the political arena by competing philosophies and priorities.

Given the critical social benefits of infrastructure, can pension funds share in the cost?

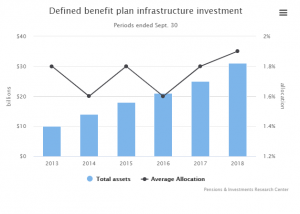

A growing source of non-government funding for infrastructure has come from targeted investment funds via commitments by pension funds and other institutional (non-retail) investors. According to Pensions & Investments, global assets under management in infrastructure increased from about $130 billion in 2009 to $470 billion in June 20181. Of this total, 45% was managed in North America, 34% in Europe and 21% in Asia and rest of world. The broad areas of infrastructure investments have included energy, renewables, transportation and social infrastructure (e.g. education, health care, housing). The chart below indicates that infrastructure investment by US defined benefit pension plans has risen from $10 billion in 2013 to over $30 billion in 2018. Key to the growth in pension plan investment has been the emergence of infrastructure as a distinct asset class alongside stocks, bonds, private equity, real estate and cash. Another important development for pensions has been the introduction in 2018 by the EDHEC Infrastructure Institute of a set of benchmarks, or indices, to evaluate the performance of infrastructure funds.

In addition to pension fund and local government initiatives, increased infrastructure investment by the federal government has been advocated to counteract potential US economic contraction, while increasing longer term growth and employment. However, significant federal infrastructure investment will require greater tolerance for deficit spending from Congress while partnering with Wall Street and the private sector.

1 McGrath, Charles. “U.S. Infrastructure cools in 2018: pension fund interest creeps higher”, Pensions & Investments, February 12, 2019.

NOTE: Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities. Past performance is not a guarantee of future investment results.