Investing with “Style”: Growth and Value Stocks

It is commonly stated that investing and asset allocation involve the choice between 3 asset classes: stocks, bonds and cash. However, it has long been believed that certain types of stocks behave differently from other types of stocks. This concept was first developed by Graham and Dodd in the 1930s, who believed that value stocks provided a premium return due to their true value exceeding their prevailing price in the market. Later, the researchers Fama and French developed a model of stock returns which included the styles of value, growth and size. These and other studies have helped launch a cottage industry of market indexes and funds focused on value and growth stocks.1

Value stocks can be viewed as those of companies with low price-to-earnings ratios, that is, “cheap” stocks. Growth stocks are characterized by those companies with high price-to-earnings ratios (“expensive”), but with high expected growth rates. Many technology and internet stocks have fit the definition of growth stocks, whereas energy, financial and cyclical stocks (such as retail) have often been classified as value stocks.

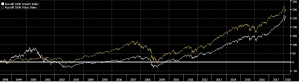

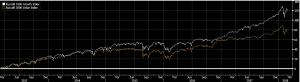

Which style has performed better? On a month-to-month basis, one style will generally outperform the other or vice-versa. Over a longer periods of time, divergent patterns have emerged. The charts below show the cumulative total returns for two well-known style indexes, the Russell 1000 Growth Index (Growth) and the Russell 1000 Value Index (Value). If we look at the 20-year period starting in 1998 (Chart 1), Value outperformed Growth over the first 10 years which included recessions in 2001 and 2008. However, over the last 5 years starting in 2013 (Chart 2), Growth has strongly outperformed Value in an expansionary period for the US economy. The recent outperformance of Growth has also been characterized by record company earnings growth, record high valuations and strong performance by the large technology companies.

Chart 1

Chart 2

Will the pattern of the last 5 years continue into the future? Unlikely, if earnings growth subsides and valuations come down. An economic slowdown or recession could also lead to a focus on stock prices and valuations characterized by Value stocks.

What does this mean for investors? If you are concerned about style risk or mistiming market cycles, it may be best to invest in a broadly diversified fund, such as an S&P 500 Index fund. Or, if you prefer to invest in style funds, a mix such as 50% Growth and 50% Value will also provide diversification and protection against sudden changes in market trends.

- Other popular styles have included small and large capitalization stocks, which have intersected with growth and value.

NOTE: Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities. Past performance is not a guarantee of future results.

About Frederic Slade

Fred Slade has over 25 years of experience in the investment management and retirement services industries. He is AVP-Senior Director, Investments for Pentegra Retirement Services, a leading provider of retirement services to financial institutions and organizations nationwide, founded by the Federal Home Loan Bank System in 1943. Mr. Slade manages over $1 billion in internal bond portfolios and provides analytics and strategy for Pentegra’s Defined Benefit and Defined Contribution Plans. Mr. Slade holds a Ph.D. in Economics from University of Pennsylvania and a CFA, and has presented at a number of seminars and conferences.